Viewpoint: Liquefied Natural Gas Solidifies Its Place in Panama

Viewpoint: Liquefied Natural Gas Solidifies Its Place in Panama

The Central American country inaugurated the region’s first LNG terminal in September.

Panama recently joined the club of liquefied natural gas, or LNG, buyers, becoming the forty-second country to import the cryogenic resource that is reshaping global industries. The isthmus was already a long-time conduit for international commerce and energy flows, and that role is bound to grow following the 2016 expansion of the Canal to accommodate larger tankers and new shipping rules that allow vessels to traverse more frequently. Its LNG import capacity now adds a new dimension to its energy profile. Beyond just a pass-through for the energy trade, Panama now has the makings for a potential hub-and-spoke model for regional energy, an arrangement that elevates its profile on the geopolitical energy stage.

A terminal opening

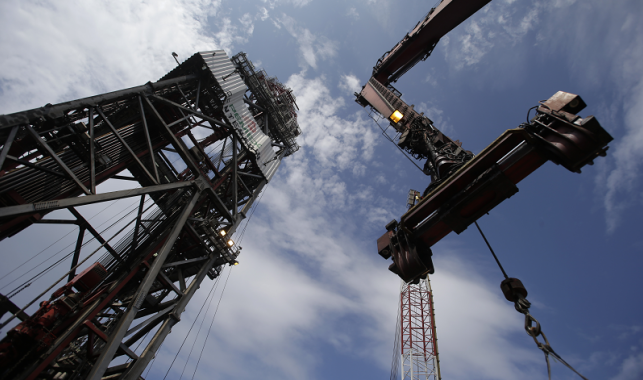

The inaugural LNG facility for Central America is the Costa Norte terminal, built by U.S. power company AES* near Colón on the Caribbean entrance of the Canal. Gas from abroad gets cooled at sub-zero temperatures where it turns into liquid form, loaded onto tankers, and shipped overseas. The regasification terminal connects to a 381-megawatt combined cycle plant to generate electricity. Commercial operations of the plant began in early September.

For at least the foreseeable future, the gas will be coming from the United States, as Panama becomes the latest beneficiary of the U.S. shale production boom. French company Total has a 10-year supply agreement with AES to provide LNG to Costa Norte, with low-cost and proximate U.S. gas being the likeliest procurement option. The facility received its first commissioning cargo in May out of Sabine Pass on the U.S. Gulf Coast.

Panama, for now, and potentially Central America later, will benefit from diversity in the energy supply. Like many countries in Latin America’s tropics, Panama generates a majority of its electricity from hydropower. Gas will not displace hydropower entirely, but it will cut into the nearly 40 percent of the electricity that Panama derives from burning petroleum and heavy fuel oils. In addition to being cleaner-burning and lower cost than oil, gas will also smooth out any price volatility that arises from buying petroleum fuels during times of drought or low water supplies.

Power plays

But geopolitics are also in play. The gas-to-power model AES employs in Panama is a close replica of its operations in the Dominican Republic for the past 15 years. Much less dependent on hydropower than Panama, the introduction of gas reduced the share of fuel oil in the Dominican Republic’s power mix by 51 percent in a roughly ten-year span. In 2014 alone, the Dominican Republic owed Venezuela nearly $550 million for oil imports through Petrocaribe, the financing arrangement through which Caracas provides Caribbean countries with oil on preferential terms. But the combination of gas and Venezuela’s declining oil production have all but eliminated the Dominican Republic’s need for Petrocaribe.

“[The Dominicans] were able to only pay half of their fuel bill, and the other half was financed at 1 percent for 20 years, which became a huge subsidy for the sector,” says Andrés Gluski, chief executive of AES. “The $500 million that we save the country [per year] is equivalent to the subsidy of Petrocaribe,” he adds in regards to AES’ operations in the Dominican Republic.

Since the onset of the U.S. shale revolution a decade ago, U.S. gas has been seen as a public diplomacy tool to compete with Venezuela’s petro-political influence in the region. Now, with the self-inflicted collapse of Venezuela’s oil sector and its inability to honor supply agreements under Petrocaribe, there is rising market-driven logic for the Caribbean to turn more to gas.

Rolling out the hub-and-spoke model

Power companies are looking to leverage existing LNG infrastructure to spread gas throughout the region. Imported gas from the United States, but also possibly from Trinidad and Tobago or Peru, would service domestic industry with a portion available to be reexported to neighboring countries.

“The LNG hub-and-spoke business model proposed by AES could open doors or smaller markets to access a cleaner and cost-efficient alternative to diesel and fuel oil for power generation,” said Diana Carranza, an Americas LNG reporter with ICIS, a gas markets intelligence firm. “The value chain would mainly be based on development of gas-to-power projects.”

From the Dominican Republic, AES is looking to export gas from its LNG terminal in Santo Domingo via small-scale barges, mid-scale vessels, or ISO containers to neighboring islands. From Panama, AES intends to eventually ship gas to other Central American countries that have scarce access to the resource. The company’s Colón power plant is contracted to use 25 percent of the terminal’s full capacity, while the remainder is free to be exported elsewhere or used to convert older facilities that run on fuel oils.

Companies in Colombia are eyeing a similar model to take advantage of the country’s LNG terminal, which went online in 2016 in Cartagena, just over 300 miles east of Colón. “Nowadays, if you have the LNG, there are different forms to get into these markets on smaller barges,” Gluski noted. “You can do it by water. It’s a lot cheaper and simpler than building a bunch of pipelines.”

Typically, LNG markets form through existing demand, such as with larger Asian consumers. “But in the case of the agglomeration of small markets, we consider it might be beneficial to start with LNG supply infrastructure to incentivize demand,” Carranza said.

But the hub-and-spoke distribution model still faces setbacks, mainly around financing. State-owned electricity distribution companies often have inconsistent payment records, making access to credit a challenge. “We are in a capacity to really help Haiti with its energy problem, but the problem is they aren’t credit-worthy off-takers,” Gluski says, referring to the possibility that AES could sell to state-owned utilities but not be paid back. Accessing credit through some sort of facility with multilateral lenders could provide stronger assurances for private investors, he notes. Also challenging the model are regional tax and regulatory measures not currently designed for the import of LNG in Central America and the Caribbean, says Carranza.

The combination of abundant supply, market demand, and creative uses of existing LNG infrastructure is creating inroads for gas penetration in Latin America and the Caribbean. Governments, regulators, investors, and the aid community have many opportunities to partner together to accelerate that rollout and create a more tightly integrated market for a cleaner and more cost-efficient source of energy.

Disclosure: The AES Corporation is a corporate member of Council of the Americas. Andrés Gluski is the chairman of the Board of Americas Society/Council of the Americas.