Update: Brazilian Pre-Salt Oil Field Auctions Raise the Bar Again

Update: Brazilian Pre-Salt Oil Field Auctions Raise the Bar Again

The $1.9 billion pledged in signing bonuses in two pre-salt auctions set a new record, though fell short of Brasilia’s goal of $2.3 billion.

As they did in September, international oil firms showed up in force again in October for auctions of Brazilian oil and gas blocks. On October 27, the National Agency of Petroleum, Natural Gas, and Biofuels (ANP), the regulatory body for Brazil’s oil and gas industry, held two highly anticipated auctions for the crown jewel of the country’s natural resources: the pre-salt fields. These were the second and third times that pre-salt fields were put to public bid and the first since legislative changes lifted a de facto monopoly by state-oil company Petrobras on pre-salt areas. Companies pledged approximately $1.9 billion in signing bonuses and offered record shares of “profit oil” to secure pre-salt development rights, breaking the previous record of $1.2 billion in signing bonuses set in September, although falling short of a $2.3 billion goal set by the government.

What was on the auction blocks

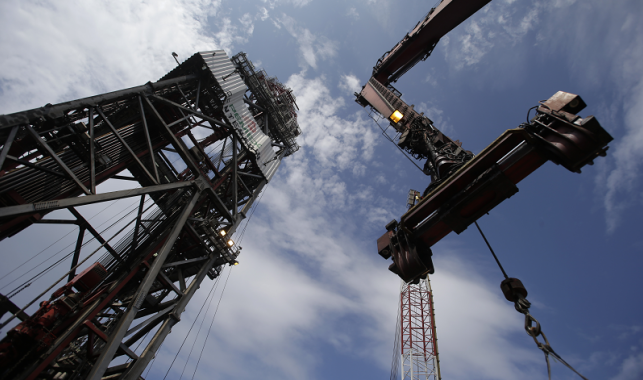

Trapped beneath thick layers of salt located miles below the ocean floor, Brazil’s pre-salt reservoirs—largely clustered off its southeast coast—are among the largest and most highly productive oil fields in the world. Their sheer size, low exploration risk relative to other offshore areas, and output rates that can register as high as 40,000 barrels per day from a single well led investors to pay top dollar for development rights.

Previously, Petrobras was required by law to hold an operator role in all of Brazil’s pre-salt projects with a minimum 30 percent stake. But a revision to that law in 2016 stripped Petrobras of its mandate and sweetened the pot by allowing international investors to bid on more market-oriented terms. That greater degree of flexibility and control over planned investments drove the strong interest in the recent auctions.

“Profit oil” is the term used to describe the percentage of oil production that companies offer to the government after recovering their initial development costs. It is a common licensing arrangement requested by governments for extremely large resources to ensure substantial payments, in addition to taxes and other royalties. And it was the sole criteria for determining the auction winners: bids were awarded based on the highest percentage of profit oil that companies promised to the Brazilian government.

Who bid what

ANP licensed six of the eight pre-salt blocks that were up for grabs. Winning bidders were all consortiums of companies comprising the largest and most experienced deepwater operators in the international oil industry. Officially the government held two separate auctions, both for pre-salt fields. The first was for four “unitized” areas, or large portions of currently contracted pre-salt fields that spill over into unlicensed areas. The second was for four entirely undeveloped fields. Prior to the auction, Petrobras still had the right of first refusal on the pre-salt fields that it wished to operate. But for the fields where Petrobras chose not to exercise its right, qualified companies were free to bid on open and competitive terms.

Royal Dutch Shell, already one of the largest foreign investors in Brazil’s offshore, participated in three winning consortiums. Its share of signing bonuses alone amounted to $100 million. ExxonMobil, meanwhile, following a September auction that marked its full-fledged entrance into Brazil, expanded its presence by picking up a 40 percent share in the Norte de Carcará field, one of the largest areas on offer. Statoil, Repsol, BP, China’s Sinopec and CNOOC, and, naturally, Petrobras were also among the winning companies.

The highest share of profit oil offered came from a consortium of Petrobras, Shell, Repsol, and Sinopec. The companies pledged an 80 percent share to develop the Entorno de Sapinhoá area in the Santos Basin. In Brazil’s first pre-salt auction for the Libra field in 2013, by comparison, the winning consortium offered the minimum 41.65 percent of profit oil to secure the block.

The two largest blocks sold, Peroba and Norte de Carcará, hold a combined 7.5 billion barrels of oil reserves and fetched 76.96 and 67.12 percent profit oil rates, respectively.

Assessing the outcome

The $1.9 billion in signing bonuses on the six blocks auctioned off fell short of what the government had expected to collect. Brasilia had anticipated selling off all eight blocks on offer to raise some $2.3 billion in signing bonuses.

Still, some within Brazil’s oil industry contend that the government left money on the table by making profit oil the lone determinant of winning bids and setting a low fixed signing bonus. Doing so reduced immediate cash payments for the government that could have been directed to improve the country’s ailing public finances.

But the high shares of profit oil that determined the winning bids were generally seen as surpassing original expectations. “Brazil is back on the global oil market scene,” said ANP Director General Décio Oddone following the auctions.