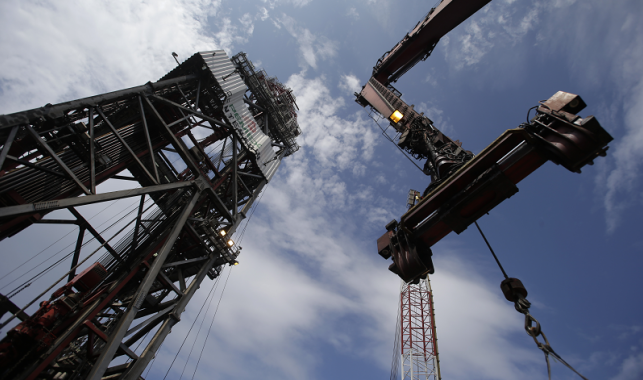

Update: Brazil's Oil and Gas Auction Breaks Records

Update: Brazil's Oil and Gas Auction Breaks Records

All told, the signing bonuses pledged on September 27 were more than double the amount anticipated.

International investors busted out their checkbooks on September 27 and pledged record amounts for the rights to develop Brazil’s oil and gas riches. The country’s fourteenth bid round for oil and gas exploration and production blocks drew more than $1.2 billion in signing bonuses from energy companies. It is the largest sum ever for a Brazilian oil auction, according to industry regulator the National Agency of Petroleum, Natural Gas, and Biofuels (ANP).

Bright spot in bearish times

Amid the political scandals and economic setbacks that have dented investor confidence in Brazil, the country’s energy industry typically has been viewed as a bright spot. Indeed, the government framed the outcome of this week’s auction as providing a major boost to the economy at large. “These measures will bring hundreds of billions of reais in investments, that is, wealth to the Brazilian society,” said ANP Director General Décio Oddone.

ANP awarded a total of 37 blocks of the 287 that were up for grabs. Twenty companies from eight countries participated in the bidding, with 17 firms ultimately acquiring acreage. The acquired blocks span eight sedimentary basins—both onshore and offshore—and comprise 25,000 square kilometers of total acreage. A majority of the interest and money paid was concentrated in Brazil’s offshore territory, particularly the Campos Basin, which sits adjacent to the country’s prolific pre-salt areas. Pre-salt fields, which account for majority of Brazil’s total oil production, were not on offer, but they will be the focus of their own separate auctions to be held on October 27.

The bid round resulted in just 13 percent of the blocks on offer being awarded, with some observers saying oil prices and a lack of investment cash played a role. Despite that, the round managed to attract the biggest names in the international energy industry. Ahead of the auction, Oddone indicated that the government would not measure the success of the round by the number of blocks awarded, but by the caliber of companies that participated.

A giant steps into the ring

Most notably, the auction saw ExxonMobil vastly expand its presence in Brazil. The U.S. major picked up 10 blocks through the course of the day—six in a consortium with Brazilian national oil company Petrobras, two on its own, and an additional two in partnerships with U.S. independent Murphy Oil and local Brazilian entity Queiroz Galvão. Prior to September 27, ExxonMobil had only a marginal presence in Brazil’s upstream, owning a few blocks in the country’s northern equatorial margin. In contrast, other major international oil companies such as Chevron, Royal Dutch Shell, and Statoil of Norway have long staked Brazil as a core piece of their global activities.

ExxonMobil’s 50-50 consortium with Petrobras for six offshore blocks resulted in the lion’s share of signing bonuses pledged. The companies offered up a combined $1.13 billion in signing bonuses for the six areas, equal to 93 percent of the auction’s total. The firms also presented the single largest bonus for one area—roughly $700 million for a Campos Basin block. Bidding was fierce among the high-profile industry investors: one sum offered by ExxonMobil and Petrobras was five times higher than the runner-up’s bid. Another was more than 25 times the second-place consortium of BP and France’s Total. All told, the signing bonuses pledged were more than double the amount that the government anticipated it would collect for the auction.

Other big winners included China’s state-owned CNOOC and Spain’s Repsol, which picked up offshore blocks for $7.4 million and $7.2 million, respectively.

The success of the round is in part a vindication for the market-friendly regulatory reforms implemented by the Temer administration to court international oil investors. Brazil’s last oil auction in December brought in just $38 million in signing bonuses as investors shied away, discouraged by both a drop in oil prices and regulatory burdens on the industry. But among the recent reforms, the government lowered local content requirements for oil projects and removed them as bidding criteria, established separate royalties for new frontier areas to incentivize exploration risk, and renewed a crucial “Repetro” customs regime that provides tax benefits for industry.

What’s to come in October

The auction also serves as an early gauge of interest for two pre-salt bid rounds that ANP will host in October. Last year the government reversed a law requiring Petrobras to operate all pre-salt fields with a minimum 30 percent equity stake. Removing that rule now gives oil companies interested in developing pre-salt fields greater flexibility in how they manage their projects. So far 11 companies have been approved to participate in the auction. All are among the biggest names and most experienced operators in the global oil industry.