Viewpoint: Five Things to Know about Mexico's Deepwater Oil Auction

Viewpoint: Five Things to Know about Mexico's Deepwater Oil Auction

AS/COA Director of Energy Naki Mendoza outlines what made this bidding round a success and what comes next for Mexico’s energy sector.

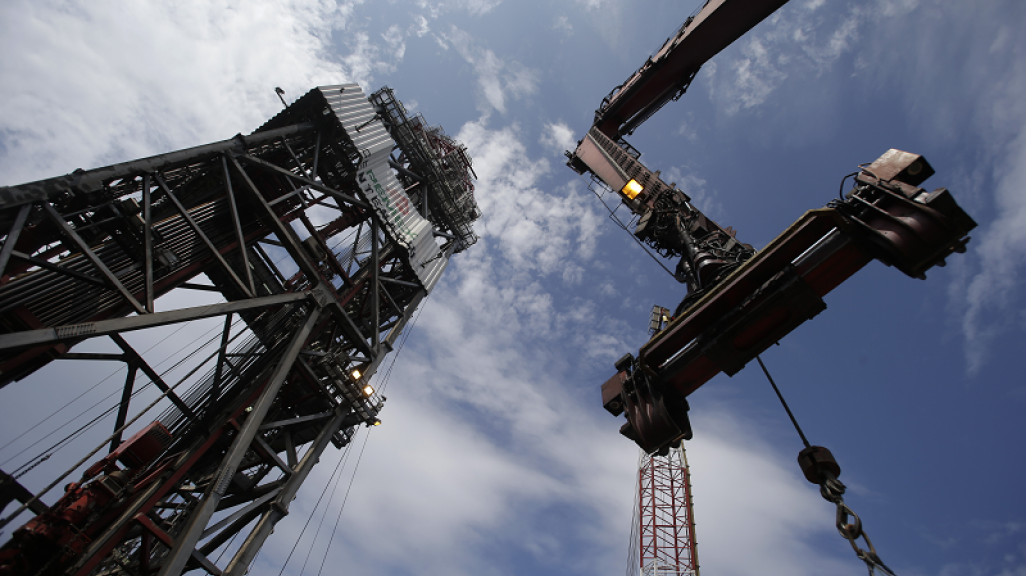

On December 5, Mexico’s government awarded exploration rights for eight deepwater blocks in the Gulf of Mexico to an array of international oil companies in a highly anticipated bid round for both country and industry. The government also auctioned off a majority stake in a deepwater oil field that will be developed in partnership with Mexico’s state-owned oil firm, Pemex. Combined, the results have been widely lauded as a success.

AS/COA Director of Energy Naki Mendoza explains the relevance of the auction’s outcome and what it signals for future investment in Mexico’s oil sector.

What was the significance of this bid round?

The December 5 tender was the fourth auction in which private investors could bid on oil and gas acreage in Mexico since 2013 government reforms broke Pemex’s then-76-year monopoly on the oil sector. Three previous auctions for less attractive acreage yielded modest sums of investment from smaller industry players. The deepwater blocks offered in the latest round were considered the prized assets because of their enormous resource potential and proximity to producing fields just over the maritime border in the U.S. Gulf of Mexico.

Despite the nearly two-and-a-half-year slump in oil prices that has slashed capital budgets for companies across the industry, some of the largest names in international oil still committed to invest in Mexico. In doing so, they represent the first wave of large-scale foreign investment in Mexico’s oil sector. Many of the winning bids surpassed the auction’s minimum requirements, indicating the premiums that firms were willing to pay to develop resources in Mexico. Their vote of confidence also provides early vindication for what has been a controversial reform process to open up Mexico’s energy sector.

Who were the big winners?

A total of 10 exploration blocks were up for grabs—four in the Perdido Fold Belt area, located immediately south of the maritime line with the United States, and six in the more prospective Salina Basin in Mexico’s more southern Gulf. All four blocks in the Perdido Fold were snatched up, while four of the six in the Salina Basin were auctioned off. Prior to this round, Mexico’s Energy Secretary Pedro Joaquín Coldwell indicated that awarding just four of the 10 blocks on offer would constitute a successful auction.

The winning bids came from all ends of the oil industry spectrum in both size and geography. Traditional Western heavyweights Chevron, ExxonMobil, Total, and BP—four of the so-called “supermajors”—all picked up acreage through a variety of consortia. So, too, did international firms such as Statoil, INPEX, and Petronas with experience in deepwater projects. Smaller independents like Murphy, Ophir, and Sierra also got in on the action. Pemex took up a participating interest in one Perdido Fold block in a consortium with Chevron and INPEX.

In addition to the eight exploration blocks awarded, BHP Billiton of Australia won a 60 percent interest to co-develop the Trion Deepwater field that was previously discovered by Pemex. Its role in operating the development of the field will bring the much-needed capital, technology, and outside experience that Pemex lacked and which contributed to the firm’s declining production over the past decade.

What stood out?

Perhaps the biggest splash came from China National Offshore Oil Corporation (CNOOC). The state-owned firm went big in the Perdido Fold, taking up two blocks as a sole bidder. CNOOC and other Chinese oil firms have participating interests in other upstream developments across Latin America. But its go-it-alone approach to operate the blocks outside of a consortium is a noticeable break from its activity across the region.

How will this transform Mexico’s oil industry?

The assigned contracts have an associated investment of approximately $34.4 billion over the next 35 years, which can have a wider ripple effect across the Mexican oil sector. The Mexican state will receive, on average, between 60 and 66 percent of the profits generated from the awarded contracts. According to Mexico’s government, the 10 blocks originally offered contain almost 11 billion barrels of oil-equivalent resources. Juan Carlos Zepeda, presiding commissioner of Mexico’s National Hydrocarbons Commission, has estimated that the areas awarded in the recent auction could eventually add up to 900,000 barrels per day to Mexico’s oil production. That would provide a healthy boost to Mexico’s sagging oil output, which has dwindled by nearly 30 percent from its peak in 2004.

However, no immediate jolts are expected in the near-term. First oil from the Trion field is not expected until 2023, and the exploration blocks awarded will likely take up to 10 years to develop.

What comes next?

The December 5 auction was the final of the first round of public oil auctions, as outlined in the government’s 2013 energy reforms. The next stages of the second round are already underway, with new areas of shallow-water and onshore acreage due to be awarded in March and July 2017. But the positive turnout provides strong momentum for amending the next round. In concluding remarks to close out the auction, Coldwell expressed plans to hold an additional bid round for a larger package of deepwater blocks sometime in September or October 2017. Following that second deepwater round, two more auctions are slated for 2018.