Colombia Looks to Turn Commodities Wealth into Development

Colombia Looks to Turn Commodities Wealth into Development

"Infrastructure has to keep up with oil production" in order for Colombia to harness its energy wealth, observes COA’s Energy Director Christian Gómez.

Following a decade-long oil and mining boom, Colombia is facing the challenge of how to harness its energy wealth and push development forward.

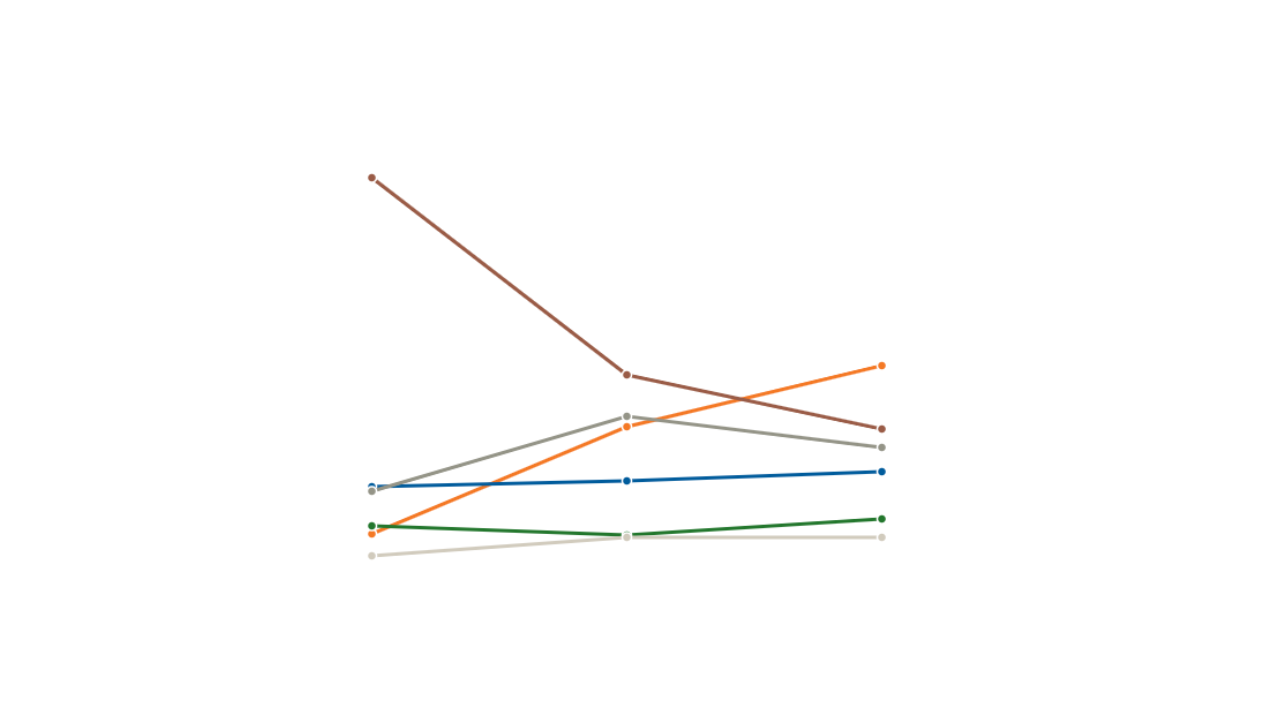

Since former President Alvaro Uribe opened up Colombia’s oil and mining sectors in the early 2000s, Colombia has gone from producing just more than 500,000 barrels per day (bpd) in 2002 to nearly 1 million bpd in 2012. Over the same period, it has seen foreign direct investment inflows jump from $2.1 billion to $15.8 billion, more than half of which was destined for the oil and mining sectors last year. Some 68 percent of Colombia’s $369 billion GDP in 2012 came from oil and mining. With the economy growing at 4 percent, the oil and mining boom has left Colombia with enough wealth to make a big difference in its development.

“Part of that growth is coming from a commodities supercycle that has clearly helped Colombia and other Latin American countries,” says Jamele Rigolini, Andean region economist at the World Bank. But growth does not always mean development. For Colombia, structural limitations behind its shining oil and mining sectors could hold development back if the country doesn’t put its energy wealth to good use.

One of those limitations is infrastructure, particularly an outdated transportation network that is eroding Colombia’s competitiveness. Manufacturers pay more to truck their products from the interior to port than it costs to ship those products from port to markets halfway around the world. Julian Trujillo, an executive at industrial adhesives manufacturer Saint-Gobain, says that the government has neglected infrastructure development, letting costs fall on businesses and in turn denting industry’s ability to compete globally....

“Infrastructure has to keep up with oil production,” observes Christian Gómez, director of energy at the Washington office of the Council of the Americas.* “So China’s looking at this as an interesting opportunity.”

But feeding China’s new energy appetite is unlikely to be the saving grace for Colombia’s development in the long term. The other crucial ingredient for Colombia’s long-term development is whether the government arrives at a peace deal with the FARC, the country’s largest and longest-standing rebel group. Peace with the rebels would likely mean more security for Colombia’s entire economy, not just its energy infrastructure; guerrilla attacks still set back production. A peace deal could also mean less military funding and more spending on transportation, health and education in the future....

Read more about this article here.