Venezuela Country Update

Venezuela Country Update

Topics in this issue:

• Chávez’s new term

• Nationalization plans

• Oil companies

Topics in this issue:

• Chávez’s new term

• Nationalization plans

• Oil companies

President Hugo Chávez’s new term began with a bang. In one of his first moves he replaced 15 key ministers, further moving the overall cabinet composition in the direction of younger, ideologically driven policymakers. Rodrigo Cabezas, a trained economist, will be taking charge of the finance ministry. As the former head of the financial committee in the National Assembly, Cabezas endorsed regular increases in government spending to fuel growth. Another notable change is the replacement of one of the more independent voices in Chávez’s close circle, José Vicente Rangel, with new Vice President Jorge Rodríguez. Since first entering office in 1998, the number of government ministries has increased from 12 to 27.

Chávez also announced his desire to nationalize key sectors of the economy, amend the constitution to eliminate presidential term limits, and abolish Central Bank independence. With passage of legislation granting the president authority to rule by decree in 11 key areas for 18 months, Chávez now has complete power to usher in any changes. Of course, with opposition representation in the legislature having disappeared after the withdrawal of opposition candidates in the 2005 elections, Chávez essentially retains control over all 167 seats in the National Assembly.

Nationalization plans. Chávez’s “21st Century Socialism” took a bold turn in January when he announced plans to nationalize two key sectors of the Venezuelan economy—telecommunications and electricity. C.A. Nacional Teléfonos de Venezuela (CANTV), a former state-run company, is the primary provider of fixed line telephone service and retains the largest shares in mobile services and internet markets. Privatized in 1991, CANTV is run by Verizon Communications, Inc. (28.5 percent share), Telefónica S.A. (6.9 percent), Mercantil Servicios Financieros, América Móvil, and the Venezuelan government. In the last 15 years, telephone service has expanded from 2.2 million fixed lines to about three million fixed lines and an additional five million cell phones. Founded in 1930, CANTV has a history of alternating government control—it was first nationalized in 1950 as part of a broad state take-over plan.

Venezuela’s largest private company, Electricidad de Caracas (EDC), is also in the government’s sights. In the same speech, Chávez promised to nationalize 100 percent of the electricity sector. EDC, privatized for $1.7 billion in 2000, provides power and light nationwide and operates five generation plants. Nationalization would throw into doubt the company’s $75 million planned investment in a power plant expected to increase capacity and growth by eight percent.

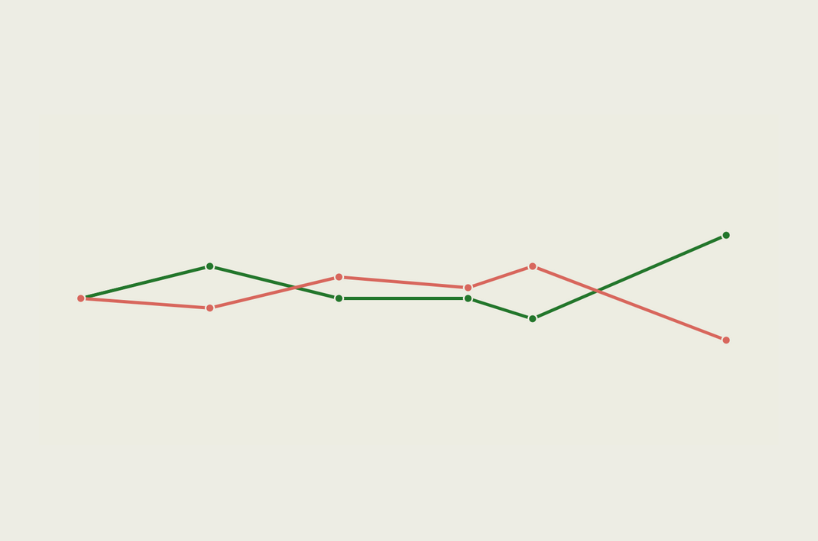

Government threats to nationalize are commonplace these days, with the latest taking place last August when it also threatened CANTV in what appeared to be a tactic for prompting contract negotiation and revision. At first glance, it appeared this most recent announcement could have been a threat, following the pattern from the past eights years. But, international markets were not so sure. The day after the announcement, American Depository Receipts of CANTV, the only publicly traded Venezuelan company on the New York Stock Exchange, plummeted and the Caracas Stock Exchange suffered an equal blow. If the Venezuelan government were to follow through on the nationalizations, it would be challenged with delivering the same level of predictability and management seen in both sectors today. Since privatizations the electricity and telecommunications sectors have improved efficiency and accessibility for Venezuelans.

Adding to the rhetoric, Chávez announced that oil companies in the Orinoco Belt—the world's largest accumulation of heavy and ultra heavy oil— should be “state property.” Rafael Ramirez, Minister of Energy and head of the state oil company, PDVSA, confirmed the president’s statement in declaring that companies operating in the region could eventually be nationalized. Under a similar scenario in 2005, PDVSA was granted a majority share in joint ventures operating in fields producing easier-to-process crude.

If nationalized, PDVSA would face the challenge of maintaining current production and seeking out future exploration while trying to lock-in maximum value for the heavy oil. According to FITCH Ratings, PDVSA’s capital investments programs, which include improving production and refining capacity, would need third party investment. Weighed down by a heavy tax burden— one half of fiscal revenue comes from PDVSA—bleak investment prospects are not a surprise.

This update is published by the Americas Society and Council of the Americas, non-partisan organizations founded to promote better understanding and dialogue in the Western Hemisphere, working in collaboration to advance their respective missions. The Americas Society is a public charity described in I.R.C. Section 501(c)(3), and Council of the Americas, a business league under I.R.C. Section 501(c)(6). The positions and opinions expressed in this publication are those of the authors or guest commentators and speakers and do not represent those of the Americas Society and the Council of the Americas or its members or the Boards of Directors of either organization. No part of this publication may be reproduced in any form without permission in writing from the Americas Society and Council of the Americas.