Stock Market Integration: Chile, Colombia, and Peru

Stock Market Integration: Chile, Colombia, and Peru

Against the backdrop of sustained regional growth, Chile, Colombia, and Peru moved one step closer to an integration of stock markets that could add a new dimension to their strong economic performance.

At a time when many Latin America economies continue to impress, three countries are on track to merge their stock markets. The decision by Chile, Peru, and Colombia to consolidate their stock markets and depositary trusts has been wrought with challenges, including internal market reforms and domestic political opposition. Despite obstacles to implementing the integration, the first step will take place before the end of the year.

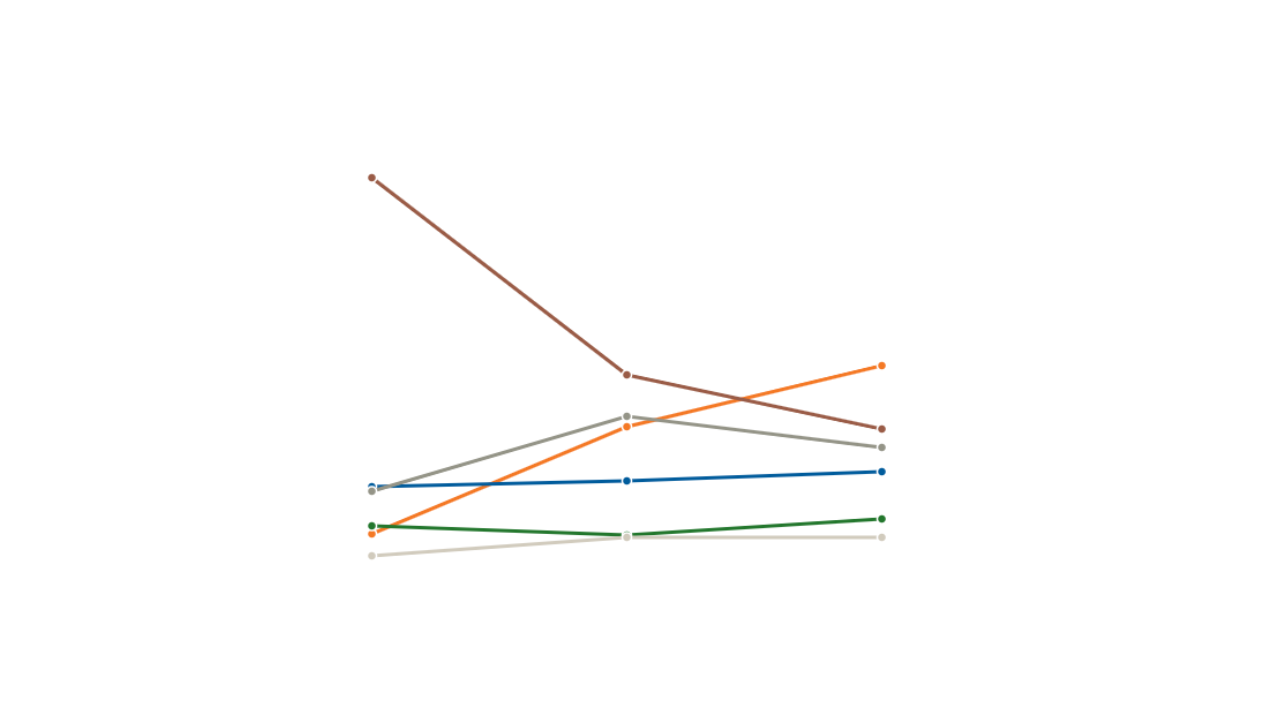

The market integration process will take place in two stages. The first, called Intermediate Routing, launches in November and gives traders in each country access to securities markets in others through the appropriate regulatory bodies. The second stage, slated for December 2011, will allow for direct access to trading markets and the standardization of market rules and regulations. Last year, the total value of stocks traded on the exchanges of all three countries was just under $56 billion. Chile—the largest exchange—accounted for $34.7 billion, followed by Colombia with $16.5 billion and Peru at just over $4 billion. Using estimates from Europe’s stock market integration, officials estimate that the total value of stocks traded could soar to as much as $460 billion as a result of integration. The integration agreement is also expected to increase market liquidity in all three countries.

Despite misconceptions, the agreement will not result in a total merger of stock exchanges from all three countries into one, given that each stock market will operate under the auspices of the relevant regulatory body in each country. Instead, the deal will facilitate trilateral trading and investing by reducing transaction costs, improving the identification of traders and their national origin, stabilizing exchange rates, and removing conflicting tax laws. For example, a Colombian investor can currently purchase shares of companies in Chile and Peru. However, he must do so only through stockbrokers that have trading agreements with counterparts in the respective country. This arrangement can incur significant trading costs and create a hurdle before traders can act. The Market Integration Plan seeks to rein in these barriers.

Although in its infancy, the market integration plan between Chile, Peru, and Colombia could also represent a new avenue of competition for Mercosur. The Southern Common Market already implemented its version of stock market integration in 2004, and this month reaffirmed its goal of establishing a free trade agreement with the European Union by next year. In 2009, Mercosur’s largest economy, Brazil, handled $1.3 trillion of stock trading—more than three times the expected value of the integrated market between Chile, Peru and Colombia.

The three countries expect to complete their stock market integration by December 2011. Finance ministers from Chile, Peru, and Colombia are scheduled to meet in Bogotá in June 2011 to review implementation details for the final stage of the two-step integration plan.

Learn More:

- AS/COA will host an event titled, “Colombia, Peru, and Chile Stock Market Integration.”

- AS/COA will host President Sebastián Piñera of Chile on September 22.

- AS/COA will host President Alan García of Peru on September 22.

- AS/COA will host President Juan Manuel Santos of Colombia on September 23.

- World Bank report on Chile, Colombia, and Peru.

- Business News Americas has a report on the Stock Market Integration of Colombia, Peru and Chile.

- Prudential Investments has a report on Latin America’s Markets.

- A Chilean Securities and Insurance Supervisor press release on the Market Integration Plan.