Interview: COA's Eric Farnsworth on Asia-Latin America Ties

Interview: COA's Eric Farnsworth on Asia-Latin America Ties

After a trip to Singapore, COA’s Eric Farnsworth talks with AS/COA Online about the APEC summit, progress in charting a trans-Pacific trade agenda, and China's economic role in Latin America. "I see China as being a real engine of South American economic restoration," says Farnsworth.

Just after a trip to Singapore for the Latin Asia Business Forum, Council of the Americas’ Eric Farnsworth talks with AS/COA Online's Carin Zissis about the Asia-Pacific Economic Cooperation (APEC) summit, progress in charting a trans-Pacific trade agenda, and China's growing economic role in Latin America. "[The Chinese are] the new guys on the block, but they still have a long way to go before they even begin to approach U.S. investment in the region," said Farnsworth. "Having said that, their ways of doing business are different. Their priorities are different and it is changing both the political and economic dynamic in South America."

AS/COA Online: You just got back from Singapore where the APEC summit took place. On the sidelines of APEC, a number of Latin American countries took steps to initiate or move along bilateral trade agreements with Asian countries. Could you talk about what this web of bilateral ties mean for Asian-Latin American relation and for a broader trans-Pacific trade deals?

Farnsworth: On one hand, it’s very positive because it shows Asian and Latin American economies recognize the benefit of enhancing trade and investment relations. I think it’s recognition of an emerging economic reality in the trans-Pacific region and it’s very positive for those Latin American countries that, to this point, haven’t really had a lot of access to Asia. This gives broader and preferential access and I think that’s all to the good. On the other hand, it’s not so good because a proliferation of individual trade agreements, while perhaps good for bilateral relations between the parties to the actual agreement, can actually complicate international trade through matters ranging from trade and investment diversion to supply chain management to just simply knowing what tariff rates are for which economies.

Ideally what you would have in the trans-Pacific region would be one agreement that would cover all the regional economies and greatly simplify trading and investment relations in the Pacific region. That is what has been intended through the idea of a Free Trade Area of the Asia Pacific (the FTAAP), which has been an APEC goal for some time but, given the politics of the region, is not going to happen anytime soon.

One of the most promising and, in my view, the most promising step that can be taken is the conclusion of the Trans-Pacific Partnership. The idea that has come out of several Asia-Pacific countries is to try to create a high-standard trade agreement with economies that have trade deals with the United States. So you’ve got Chile, Singapore, New Zealand, Australia, Vietnam, Peru, and Brunei. To the extent that this really becomes operational—and that’s a big “if””—it could provide a way forward to a broader pan-Pacific trade agreement, which I think is ultimately where we should be going.

AS/COA Online: So this would come out of the P4? Can you explain what the P4 is?

Farnsworth: The P4 is the original agreement initiated by Chile, New Zealand, Singapore, and Brunei about two years ago now. At the time it was not so significant given the context of the economic size and the number of countries included. The reason why it’s become interesting is because, before the election, the United States declared its desire to participate in the P4 discussions. And as soon as the United States came on board, then you had some very significant interest from other economies.

After the election, all trade policy was put on hold. And, until the president gave a speech in Japan on November 14 where he included a line about reengaging on these issues, not much was thought to come of this agreement. So where we are now is there’s some desire to explore it to see where it can take us.

AS/COA Online: While in Asia, President Obama suggested that Washington would potentially move forward on a bilateral trade deal with South Korea. What does that mean for pending deals with Panama and Colombia?

Farnsworth: At one level it’s unrelated because this will be a bilateral issue and the issues will be dealt with based on the political obstacles inherent in that agreement, particularly on beef and autos. But at another level it’s directly related because there’s only so much traffic that Washington can bare on trade, particularly in an economy that has not yet recovered and when unemployment rates continue to rise. So, with more attention and political capital spent trying to move forward on Korea, one could suggest that there will be less political capital to move forward on Colombia and Panama, simply because of the amount of time and attention that will be given to pending trade agreements. You can also make the case that building momentum on South Korea could potentially build momentum for other pending trade agreements, i.e. Colombia and Panama.

I tend to come down on the side of seeing the two as unrelated. I think that all three countries have specific issues before they’ll move forward to the U.S. Congress and that as long as healthcare and Afghanistan and other issues remain on the plate, those will continue to take top priority.

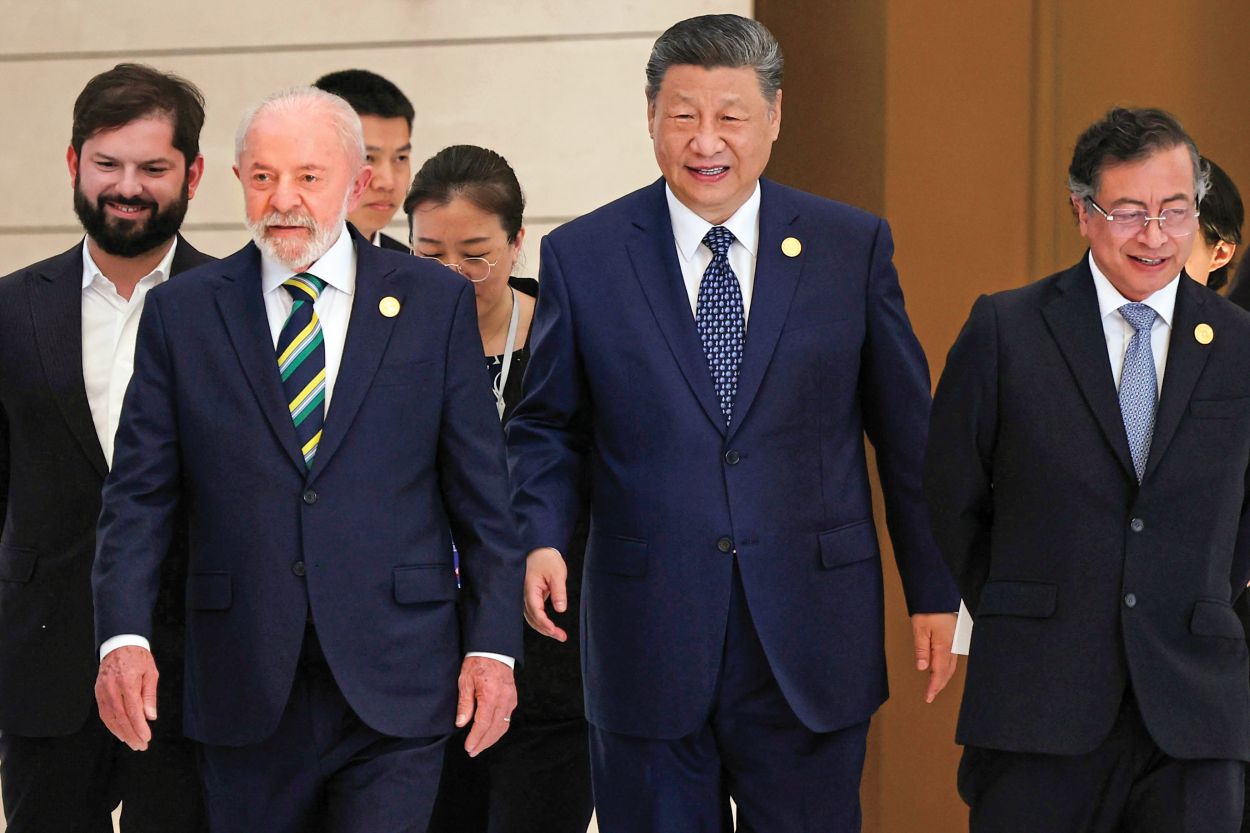

AS/COA Online: In recent years, China and Latin America’s relationships have deepened. What role do you see China playing in Latin America’s economic recovery?

Farnsworth: I think it’s playing a huge role, because China’s growth this year and next year is predicted to be 8, 9, or 10 percentage points, which is amazing when you consider where we are in the context of global economic recovery. At the same time, even the most optimistic projections would suggest that the United States is only going to recover at anywhere from 1 to 3 percent next year and for the foreseeable future. What that means is that a country in Latin America that has the ability to export commodities to China clearly has an advantage. So I see China as being a real engine of South American economic restoration—and I say South American instead of Latin American because of the commodities trade. But even that breaks down even further. A country like Brazil or Peru or Chile will do pretty well whereas South American countries that don’t have the direct links to China may not be able to benefit in the same way. The short answer is that China plays a very large role and it will play an increasingly large role.

Now, that’s a separate issue from Chinese investment into Latin America and how that’s going to play out. Even today, Chinese investment in Latin Americas is simply dwarfed by U.S. and European investment in Latin America. So, yes, they’re the new guys on the block, but they still have a long way to go before they even begin to approach U.S. investment in the region. Having said that, their ways of doing business are different. Their priorities are different and it is changing both the political and economic dynamic in South America. I don’t think we’ve seen the final picture in terms of what all the implications are on that.

AS/COA Online: Is there a danger in the relationship with China being largely based on commodities rather than other types of products?

Farnsworth: The commodities trade is rather cyclical and so that means that there are busts as well as booms. For the foreseeable future, the forecast is that China is going to continue to grow pretty aggressively. That would indicate to some that there’s been a secular shift in the global commodities trade because China’s economy will always demand commodities and therefore the cycle of boom and bust has been broken substantially. I don’t subscribe to that necessarily. I think that maybe there have been some changes, but if you’re fundamentally dependent on one product category and you’re less diversified, then I think you’re always going to be more vulnerable to downdrafts in the global economy. And that’s exactly what we’ve seen over the last 18 months.

Now, fortunately for Latin American economies, they’re coming out of it quickly and for all the right reasons. But that’s not to say that the same thing couldn’t happen again. The countries that are more diversified are going to stand a better chance of weathering severe global economic downturns because they’re going to be able to not just export commodities but also add value to the products that they sell while developing their own domestic markets to boost domestic consumption and, therefore, GDP figures. You would hope that at least some of the countries would use this crisis to take steps to diversify their economies.

I think the one other point I’d make is that Hu Jintao, the premier of China, has gone through South America a couple times and promised all this investment. The reality is it hasn’t materialized. There’s some cynicism setting in in parts of Latin America about the Chinese in terms of what they promise and what they deliver. I think, again, that remains to be played out fully.

AS/COA Online: Mexico is the top location for manufacturing products that are sent to the United States. Do you see China outsourcing to Mexico for manufacturing goods for the U.S. market? What could that mean for the Mexican economy?

Farnsworth: I think that’s a real possibility, although that was the specific reason in the NAFTA [North American Free Trade Agreement] negotiations for drawing strict rules of origin. At the time—15 years ago—it wasn’t done because of China, it was done because of Japan. The fear was that the Japanese would produce in Mexico, and use NAFTA provisions to export from Mexico to the United States.

It’s ironic now that people are concerned about China. The fact is, yeah sure, it’s a possibility and there’s a lot of Asian investment in the maquila sector Mexico. It’s not just Japanese. A lot of it is South Korean, some of it’s Taiwanese, and it’s increasingly Chinese. The maquila sector is, by definition, there to serve the U.S. market. Clearly, people want to be close to the U.S. market and the Chinese are no different. Even with China’s explosive growth over the last generation, the U.S. economy still dwarfs even the Chinese economy.

AS/COA Online: Occasionally media reports suggest China could some day replace the United States in terms of influence in Latin America. How do you see that in the long-term?

Farnsworth: If you talk to the Chinese, they swear up and down that their interest is economic and financial. They don’t seek a political role in the region. Their own participation in Latin American issues might be growing, but it still remains pretty limited and they pose nothing but a benign commercial presence on the region. Anytime the Chinese have been brought into a political discussion, it’s generally at the instigation of a Latin American party, specifically Venezuela. But you don’t get the Chinese at APEC talking big about how they’re going to take over Latin America to supplant the United States. In fact, I don’t think that they will. I don’t think that’s their intent.

But that’s not to say that a new, emerging presence isn’t changing things and that, at some point, it may have some implications for the United States. At the basic level, in terms of contracts and energy explorations and trading relationships, it’s certainly possible that Chinese trade and investment could supplant at least a portion of Washington’s. At another level, I think that a reduction of U.S. influence in the region has more to do with other factors than an increase in Chinese influence, not the least of which is Brazil’s own emergence. There are a lot of factors at play here. The bottom-line with China is that it’s an issue of importance and it bears watching, but we can’t say just yet what the ultimate outlines are going to look like because we’re still in pretty early days.