Update: The Battle over Mexico City's New Airport

Update: The Battle over Mexico City's New Airport

Mexicans will decide the fate of the $13.3 billion megaproject during an October 25–28 public consultation. But canceling the airport comes with costs, too.

From October 25 through 28, Mexicans have the chance to vote for or against a $13.3 billion megaproject. Their decision could have major implications for their country’s economy, given indications that the cancellation would leave investors skittish.

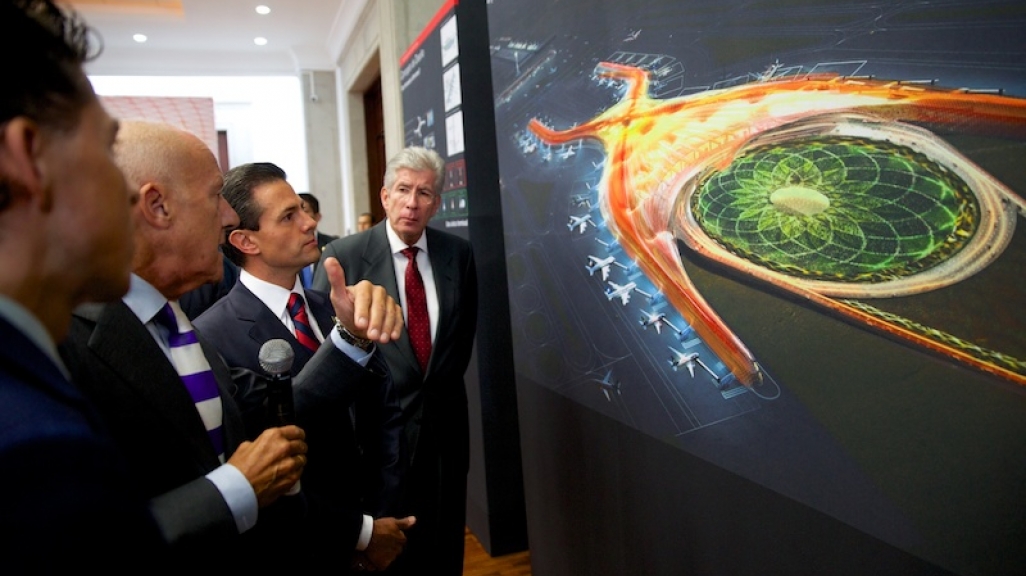

The New International Airport of Mexico City (NAIM), which lies on the outskirts of the capital in Texcoco, is the landmark infrastructure project of the Peña Nieto administration and the biggest airport under construction worldwide. But the team of President-elect Andrés Manuel López Obrador, often referred to as AMLO, will hold the public consultations to decide whether or not to finish building the megaproject based on the outcome.

At different points during the presidential race, AMLO, who takes office on December 1, talked of shutting down the project if he won. His team has offered an alternative: a $3.6 billion plan to turn the Santa Lucía Air Force Base into a civil airport and expand it, as well as renovating the city’s main Benito Juárez International Airport and a smaller airport outside the capital in Toluca.

We take a look at why both the Texcoco project and the consultation to decide its fate are stirring controversy.

A longstanding problem with a big price tag

Over the past two decades, Mexico has evaluated different ways to solve Mexico City’s airport capacity problem. The capital’s current airport is designed to handle 32 million passengers annually, but in 2017 it registered a passenger flow of 45 million. The new airport is slated to start operations in 2022, two years behind schedule from the initial master plan, when it will initially have a capacity of 70 million passengers. When the project is completed, capacity will reach 120 million.

One issue for criticism is the price tag. Official reports put the airport’s progress at about a third done with 70 percent of its financing requirements secured. But the project’s costs in pesos have increased by 70 percent, thanks in part to the currency’s depreciation since 2014, reports the Mexican Institute for Competitiveness (IMCO).

Still, GACM, the state-owned company behind the construction of NAIM, argues that the site where NAIM currently sits has been thoroughly researched for viability. Several aviation-specialized organizations, both international and national, have studied both NAIM and the Santa Lucía option and came down on the side of the Texcoco site.

Whether Santa Lucía is even possible remains a question. MITRE, a U.S. nonprofit specializing in air traffic management, found that the simultaneous operation of Santa Lucía and the current airport “is not viable, either in the short or long term” partly because the two airports would share the same airspace. On top of that, the UN’s International Civil Aviation Organization and Mexico’s School of Civil Engineers point out that the alternative option does not solve the capacity problem in the long term. But, just in time for the consulta, AMLO’s team heralded a new report by Navblu, an Airbus company, saying that Santa Lucía is viable.

Controversy over both NAIM and the consultation

NAIM has been questioned over concerns related to the potential for corruption, given that IMCO found that 157 of the 320 contracts analyzed were issued as direct awards. Other issues include the environmental impact as it’s located on marshland, as well as how local communities will be affected. But cost remains the biggest sticking point for an incoming government expected to expand social spending. During the presidential campaign, Javier Jiménez Espriú, tapped as the future communications and transportation secretary, said the country could not afford to use public money for such a high-cost project.

Mario Delgado, now the Morena party leader in the Chamber of Deputies, contended in August that the consultations promote a participatory democracy, But how NAIM’s fate will be decided has also been questioned. AMLO says the outcome of this weekend’s consultation will be binding, although observers have raised concerns about the lack of constitutional grounds to validate the consultation as a referendum, the incoming administration’s bias in favor of Santa Lucía, and the fact that the consultation will be financed by the president-elect’s inner circle.

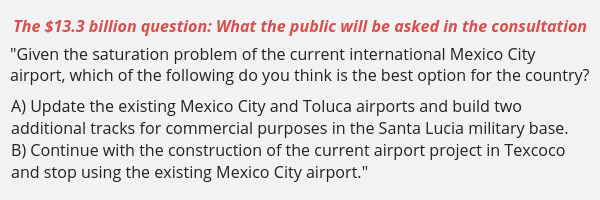

The public consultation will take place over the four-day period in 538 of the country’s 2,458 municipalities at 1,073 voting stations. Yet only 1 million ballots will be available—a small number considering that 90 million Mexicans were eligible to vote in this year’s presidential election.

The Arturo Rosenblueth Foundation, an academic nonprofit with a focus on applied computer science, will oversee the consulta with the help of volunteers instead of the National Electoral Institute. Estimates put the cost of the public consultation at close to $78,000, and it will be financed by contributions made by legislators from Morena, AMLO’s political party.

Then there’s the issue of the wording. An El Financiero poll published October 23 found that Mexicans favor the completion of the new airport. On the other hand, the poll also found that respondents prefer Santa Lucía when asked the exact question that will appear on the ballot.

The cost of cancellation

Despite worries over the Texcoco airport’s cost, there’s also concern about the cost of canceling, which GACM puts at $6.6 billion. With a significant amount of private capital committed and legal contracts involved, a shutdown would negatively impact investor confidence in the Mexican market, says Fitch Ratings. That could complicate involvement in future infrastructure projects, such as AMLO’s proposed tourist train project in the Yucatán Peninsula known as the Tren Maya—for which no consultation is being considered.

Days before the consultation, AMLO released a video saying the project’s cancellation would not harm the Mexican economy because he would reach a deal with companies involved in the construction, offering to let them continue construction at the Santa Lucía site. Still, the peso has taken a hit ahead of the vote.

Whatever the outcome, the decision on whether to expand at Santa Lucía and cancel Texcoco could shed light on AMLO’s future decision-making process on matters of public policy. The next president has already suggested his administration will hold referendums on key issues such as the fate of education and energy reforms, and even putting himself up for recall halfway into his six-year term.