Explainer: A Look at NAFTA's Biggest Trade Disputes

Explainer: A Look at NAFTA's Biggest Trade Disputes

Whether over tomatoes or timber, Canada, Mexico, and the United States have had their fair share of disagreements since the trade deal's 1994 implementation.

From tomatoes to trucks to timber, disputes among the three countries of the North American Free Trade Agreement have been a reality of the deal since its implementation in 1994. After criticizing the trade relationship with Mexico throughout his presidential campaign and first months of his administration, U.S. President Donald Trump more recently pivoted to pointing fingers at the northern neighbor, highlighting issues with exporting dairy to Canada and importing lumber from it.

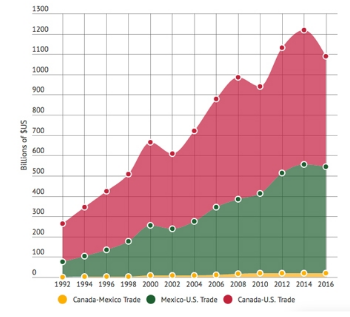

Canada is, in fact, the most sued country under NAFTA, with 35 cases brought against the country—the majority from U.S. businesses. On the other hand, there have been 22 claims brought against Mexico and 20 against the United States. Yet, the 23-year-old deal has been largely successful for all parties involved, growing trilateral trade from $346 billion in 1994 to more than $1 trillion in 2016. At this point, supply chains across the continent are so integrated that trade ties are virtually unbreakable. That doesn’t mean, however, that there isn’t room for improvement, and Mexico has demonstrated its interest in modernizing the accord.

We take a look at some of the top current and former sticking points between the three countries.

| U.S-Mexico Disputes | U.S.-Canada Disputes | Trilateral Disputes |

| Sugar | Softwood Lumber | Meat Labeling |

| Tomatoes | Dairy | |

| Trucks | Oil & Gas | |

| Tuna |

U.S.-Mexico Disputes

Sugar

The fructose friction between Mexico and the United States is an ongoing issue that arose from nearly the very start of NAFTA. As recently as May 2, U.S. Commerce Secretary Wilbur Ross set June 5 as the latest deadline to reach an agreement. A lack of an agreement could mean a trade war: while U.S. companies claim that Mexico is dumping sugar, Mexico claims the United States is dumping high-fructose syrup.

Taking a step back to look at the history of this dispute, sugar holds a special place in America’s heart. Since a 1981 farm bill, the government has protected the industry by setting minimum price levels for producers. Additionally, sugar processors can access loans using sugar as collateral. As a result, domestic production supplies a majority of internal demand, while Mexican imports contribute 10 percent of it. In 2014 the U.S. sugar industry—colloquially referred to as Big Sugar—started complaining that Mexico was taking an increasing market share, causing losses of up to $1 billion that year. The Obama administration issued an investigation into anti-dumping measures that culminated in a suspension agreement by December 2014, setting a limit for Mexican sugar imports as well as minimum prices for them.

But the problem did not end there. Though Mexican refined sugar imports dropped, raw sugar imports went up, bypassing U.S. sugar mills and instead going straight to companies that liquefied it for drinks. Sugar mills started complaining of not having enough sugar to process. According to the U.S. Department of Agriculture, this also coincided with Americans’ growing preference for cane sugar—which Mexico produces—over sugar produced from genetically modified U.S. sugar beets.

Ever since, Big Sugar has asked for updates to the 2014 suspension agreement. If the June 2017 deadline isn’t met and the United States opts for imposing a tariff instead, Mexico could retaliate with a tariff of its own on high-fructose syrup from the United States. Mexico tried dealing with the growing volume of U.S. fructose in its market with a 2002 tax on drinks using U.S. sweeteners. The World Trade Organization (WTO) ruled against that tax in 2007, and in 2009 it granted the U.S. company Cargill an arbitration award of $77 million to compensate for the company’s lost business as result of what it claimed were Mexican trade barriers. Nevertheless, Mexico’s sugar industry said in March 2017 that it would ask for tariffs on American fructose—which it claims is 35 percent cheaper than Mexican domestic fructose—were there to be a U.S. tariff imposed on Mexican sugar.

Tomatoes

As Mexico’s top agricultural export to the United States, tomatoes have a contentious history in NAFTA for one state in particular: Florida. Since 1996, Florida’s agricultural producers successfully asked for a suspension agreement to combat the excess of cheap Mexican tomatoes competing with the Sunshine State’s own crops. The industry there has continued to shrink, prompting an updated suspension agreement to increase minimum prices in 2013, while companies from other states like California and Arizona backed the original deal. Still, from 2015 to 2016, Florida’s tomato industry fell from $700 million to $318 million, meaning the problem is unlikely to go away.

Tuna

On April 25, the WTO ruled against U.S. restrictions on Mexico’s fishing industry. Mexico brought the dispute to the WTO in 2008, claiming the U.S. requirements for labeling tuna catches as “dolphin friendly” were unfairly discriminating against Mexican fisherman. U.S. regulations do not allow tuna fishing if it uses the technique of encircling dolphins to catch the tuna below them. Yet Mexico had said dolphin deaths were at minimum levels while other countries did not have to meet the same U.S. standards. The United States expanded rules to all countries in 2013, but the WTO deemed the move insufficient, allowing Mexico to seek $163 million annually in trade sanctions it can impose on the United States.

The issue isn’t settled yet, though. The WTO’s ruling did not consider a second round of U.S. updates to labeling rules issued in 2016, and a second decision is expected in July.

Trucks

Fifteen years after Mexico first disputed U.S. trucking standards, the issue was finally resolved in 2015. A day before Mexican long-haul trucks were about to be granted access to the whole of U.S. territory, then-U.S. President Bill Clinton issued a moratorium, saying the trucks did not meet safety standards. Afraid of shedding jobs, the U.S. trucking industry was pressuring the White House, as well as citing fears of undocumented immigrants and drugs hidden in the cargo.

But forcing U.S. and Mexican trucks to switch cargo at the border was costly and inefficient, given that the mode of transportation was responsible for 80 percent of bilateral trade. Canadian trucks, on the other hand, gained complete access and Mexico submitted a claim to a NAFTA arbitration panel in 2000 arguing that the U.S. restrictions it faced violated the Most-Favored-Nation Treatment measure in NAFTA. Mexico won the case and was allowed to impose tariffs on U.S. imports. After $2 billion in annual retaliatory tariffs and two pilot programs testing and monitoring Mexican trucks, the United States expanded access to Mexican trucks in January 2015.

U.S.-Canada Disputes

Softwood Lumber

Trump’s April 24 announcement of his decision to impose a 24 percent tariff on Canadian lumber revives a dispute older than NAFTA. U.S. companies have long claimed that the Canadian government subsidizes the industry with low fees for chopping down trees in its government-owned territory, thus depressing prices to the point that U.S. firms cannot compete. American lumber producers first filed a case in the 1980s, with the first agreement in 1996 that placed tariffs on a portion of Canada’s softwood imports. A version of that deal has been in effect until 2015, with the exception of a five-year period between 2001 and 2006, during which heftier duties were imposed on lumber imports.

The new tariff is already in force, with a second one to be determined in June. The combined penalties could be as much as 45 percent. “Things like this, I don’t regard as being a good neighbor, dumping lumber,” Ross said on the same day of Trump’s April announcement.

Dairy

While the United States wants to keep Canadian lumber out, it’s hoping to push its dairy products in, though Canada has been trying to protect its dairy industry since the 1970s through a supply-management system that also taxed imports. Until now, U.S. farmers have been taking advantage of a loophole in the program, exporting $133 million annually of ultra-filtered milk to Canada that is not covered under the program’s tariffs. That came to an end in February when Canada announced a measure that dropped the prices of domestically produced processed milk, making U.S. exports to the country uncompetitive. An overall global glut of milk forcing U.S. farmers to dump millions of gallons annually adds pressure to states that export the most milk to Canada, like Wisconsin and New York, prompting bipartisan congressional support for a U.S. response to Canada that is yet to be determined.

Oil and Gas

More than agricultural disputes, environmental ones have consumed a majority of NAFTA claims against Canada, brought on by U.S. investors with stakes in oil and gas exploration. In the case of Lone Pine Resources Inc., the Delaware-incorporated company owns a subsidiary based in Alberta that was granted various exploration licenses. But their one off-shore license was revoked after a Canadian environmental act prevented exploration in the St. Lawrence River. The case initiated in 2013 remains open while the U.S. company claims $119 million in damages.

Trilateral Disputes

Meat labeling

Starting in 2009, Mexico and Canada filed a case against a U.S. meat-labeling regulation that requires countries exporting meat to the United States to say where each animal was born, raised, and slaughtered. In May 2015, the WTO agreed it was an unreasonable burden and allowed Canada and Mexico to carry out retaliatory tariffs worth $781 million and $228 million, respectively. Ultimately, the U.S. Congress ended up repealing the law later that year.